Introduction

Managing credit card debt can feel overwhelming, especially when high interest rates make balances grow fast. This is where low interest credit cards can make a real difference. These cards offer lower annual percentage rates (APR) or even 0% introductory APR for a period, giving you time to pay off debt or make big purchases without paying extra. Whether you’re looking for interest-free credit cards, 0 percent credit cards, or the lowest interest rate credit card, understanding your options is crucial for smart money management.

In this guide, we’ll explore everything about low interest credit cards, including types, benefits, tips to maximize them, and the best cards to consider in 2025. By the end, you’ll have all the information you need to select the perfect card and save money on interest charges.

How to Scale Cryptocurrency Exchange: A Complete Guide to Growth & Security

Top 7 Crypto Exchanges Compared: Find the Best for Your Needs

What Are Low Interest Credit Cards?

A low interest credit card is designed to charge less interest than standard cards. Interest is calculated as the annual percentage rate (APR), which shows how much borrowing will cost you annually. The lower the APR, the less interest you pay on any balance you carry.

Some cards offer 0% introductory APR, often ranging from 12 to 24 months, allowing you to make purchases or transfer balances without paying interest during that time. After the introductory period, the card switches to its regular APR, which can still be lower than average.

Key terms:

-

APR (Annual Percentage Rate): The yearly cost of borrowing on your card.

-

0% APR: No interest charged for a set introductory period.

-

Low ongoing APR: Reduced interest rate after the introductory period ends.

Examples of keywords for this section: lowest interest rate credit card, low APR credit cards, low interest charge cards.

Benefits of Low Interest Credit Cards

1. Save Money on Interest

The biggest advantage of low interest credit cards is the potential savings. Paying a lower APR or using a 0% interest card allows you to reduce or even eliminate the cost of carrying a balance. Over months or years, this can save hundreds or even thousands of dollars.

2. Make Large Purchases Affordable

High-interest cards can make big purchases stressful. With 0 percent credit cards or zero APR cards, you can spread payments over several months without extra fees. This flexibility helps you manage your budget and avoid high-interest debt.

3. Simplify Debt Repayment

Many low interest credit cards offer balance transfer options. This allows you to move high-interest debt from other cards and enjoy a lower or zero APR period, making it easier to pay off balances faster.

4. Build Credit Wisely

Using a low interest credit card responsibly can improve your credit score. Keeping balances low and making timely payments shows lenders you are trustworthy, increasing your chances of qualifying for better credit offers.

Keywords used: interest-free credit cards, zero APR, 0 percent credit cards.

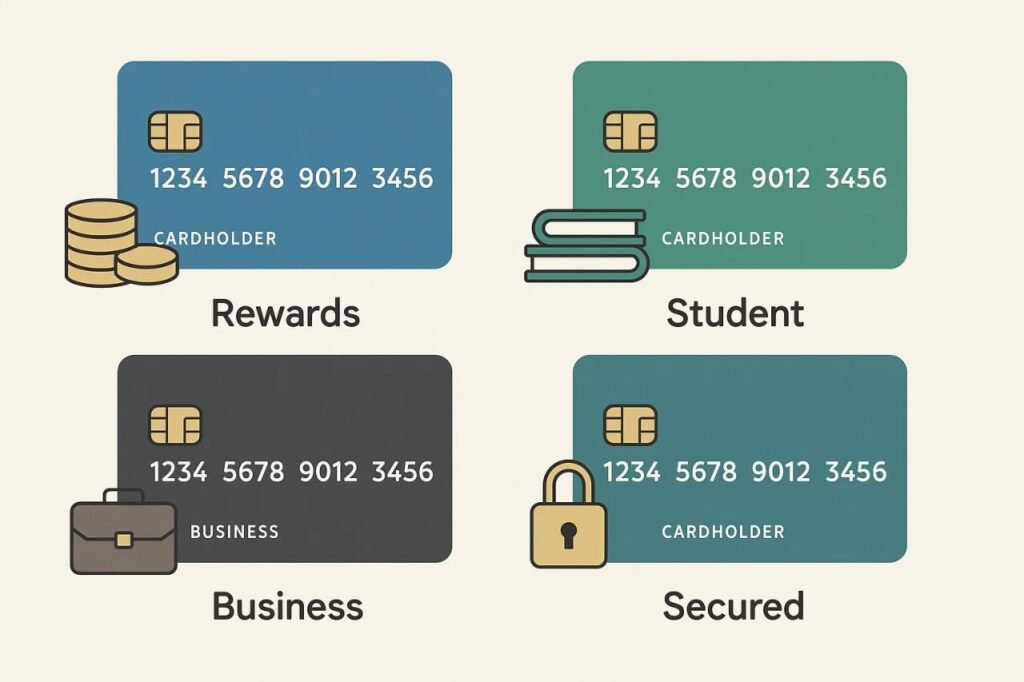

Types of Low Interest Credit Cards

1. 0% Intro APR Cards

These cards provide 0% interest for an introductory period, typically 12–24 months. They are ideal for:

-

Large purchases

-

Consolidating debt

-

Short-term financing

Top keywords: best 0 percent credit cards, best zero percent credit cards, best 0 APR credit cards.

Example: A card offering 0% APR for 18 months allows you to buy a new laptop and pay it off over time without any interest.

2. Low Ongoing APR Cards

Some credit cards offer a consistently low ongoing APR, even after the introductory period ends. These are best for people who tend to carry a balance monthly. A low APR credit card ensures that your interest charges remain manageable.

Keywords: best low interest credit cards, low annual percentage rate credit cards.

3. Balance Transfer Cards

Balance transfer cards allow you to move high-interest debt to a card with a lower APR, often 0% for a set period. This is one of the smartest ways to reduce interest charges and pay off debt faster.

Keywords: credit cards with 0 percent interest, zero percent APR credit cards.

Tip: Always check balance transfer fees; some cards charge 3–5% of the transferred amount.

4. Cards for Large Purchases

Some low interest cards are specifically designed for large, planned purchases. They may offer extended 0% APR periods on purchases rather than just balance transfers.

Keywords: visa credit card with no interest for 24 months, zero percent APR.

Example: Planning a home renovation? Using a 0% interest card over 24 months can help manage payments without accumulating interest.

How to Choose the Best Low Interest Credit Card

Choosing the right card involves more than just comparing APRs. Consider the following factors:

1. Interest Rates

Look for the lowest APR possible for both introductory and ongoing periods. This ensures long-term savings.

Keywords: best credit card interest rates, credit cards with low interest rates.

2. Fees

Check for annual fees, balance transfer fees, late payment fees, and foreign transaction fees. Some 0 interest rate credit cards waive fees during the promotional period.

3. Rewards and Perks

Some low-interest cards offer cashback or points, adding extra value. For example, earning rewards on groceries or gas while maintaining a low APR can maximize benefits.

4. Credit Score Requirements

Certain cards require good to excellent credit. Always check eligibility before applying to avoid unnecessary hard inquiries on your credit report.

5. Introductory vs. Ongoing APR

Some cards have excellent introductory APRs but high ongoing rates. Choose a card that balances both for long-term benefits.

Top Low Interest Credit Cards in 2025

Here’s a curated list of the top low interest credit cards for 2025:

1. Citi Balance Transfer Card

-

Intro APR: 0% for 18 months

-

Ongoing APR: 13.99%–23.99%

-

Highlights: Excellent for balance transfers, low fees, and flexible repayment options.

2. Chase Freedom Unlimited

-

Intro APR: 0% for 15 months

-

Ongoing APR: 14.99%–24.99%

-

Highlights: Rewards on purchases, no annual fee, perfect for everyday spending.

3. American Express Blue Cash Card

-

Intro APR: 0% for 12 months

-

Ongoing APR: 13.99%–23.99%

-

Highlights: Cashback on groceries and gas, low APR, and strong customer service.

4. Capital One Quicksilver Cash Rewards

-

Intro APR: 0% for 15 months

-

Ongoing APR: 14.99%–24.99%

-

Highlights: Simple cashback rewards, no annual fee, ideal for consistent spenders.

5. Discover it® Balance Transfer

-

Intro APR: 0% for 18 months

-

Ongoing APR: 12.99%–23.99%

-

Highlights: Great for debt consolidation with rewards for everyday spending.

Keywords used: top 0 APR credit cards, 0 interest cards, no interest rate credit cards.

Tips to Maximize Your Low Interest Credit Card

1. Pay On Time

Avoid late payments as they can trigger penalty APRs and eliminate your low-interest benefits.

2. Use Balance Transfers Wisely

Transfer high-interest balances to 0% APR cards to save on interest, but watch for transfer fees.

3. Avoid New Debt

Even low interest cards can lead to debt if spending exceeds your budget. Stick to essentials and planned purchases.

4. Monitor Your Credit

A good credit score can help you qualify for the best 0 percent interest credit cards in the future. Use credit monitoring tools to track your score and report inaccuracies.

5. Understand Terms

Always read the fine print for introductory periods, ongoing APR, and fees. Some cards may have conditions that affect your interest-free benefits.

Keywords: O credit card offers, low interest charge cards.

FAQs About Low Interest Credit Cards

Q1: How long can I have 0% APR?

Introductory periods usually range from 12–24 months. After that, the standard APR applies.

Q2: Can I transfer balances without paying interest?

Yes, with balance transfer cards offering 0% APR, but check for transfer fees.

Q3: What’s the difference between low APR and 0% interest cards?

Low APR cards offer a reduced ongoing interest rate, while 0% APR cards provide interest-free periods.

Q4: Are there cards with no interest at all?

Some cards offer long 0% APR periods, making them effectively interest-free during that time.

Q5: Can I use low interest cards for large purchases?

Yes, cards with extended 0% APR periods for purchases are ideal for big-ticket items.

Q6: Are rewards available on low interest cards?

Many low-interest cards also provide rewards like cashback or points, combining savings with perks.

Q7: How do I avoid losing my low APR?

Always make timely payments and avoid new debt accumulation to maintain your low interest benefits.

Conclusion

A low interest credit card can save you hundreds or even thousands in interest charges, especially when used strategically. From 0% APR introductory cards to low ongoing APR cards, these financial tools provide flexibility, debt management options, and even rewards for responsible usage.

When choosing a card, focus on APRs, fees, rewards, and your credit profile. Compare multiple options and pick the card that aligns with your spending habits. By using a low interest credit card wisely, you can achieve better financial control, reduce debt faster, and enjoy the benefits of smart credit management.